Lower Customer Acquisition Cost: Battle-Tested Strategies

14 mins

6/8/2025

Joe Ervin

- lower customer acquisition cost

- CAC optimization

- marketing ROI

- customer acquisition

- conversion rate

Understanding Your True Acquisition Costs Across Industries

Grasping your customer acquisition cost (CAC) is much more than simply crunching numbers. It's about truly understanding the dynamics of your specific business and the industry you operate in. Some companies seem to acquire customers effortlessly at a low cost, while others struggle. This often boils down to hidden cost drivers that many businesses fail to recognize.

Identifying these hidden costs is the first step towards optimizing your CAC. One common mistake is neglecting to analyze the entire sales cycle. Bottlenecks in your sales process, from the initial contact to the final purchase, can significantly inflate your CAC.

Hidden Costs in the Sales Cycle

A lengthy sales cycle with numerous touchpoints, for example, demands more resources and increases the cost of acquiring each customer. Inefficient onboarding can also lead to early customer churn, further pushing up CAC. Streamlining these processes is crucial for achieving sustainable growth.

While benchmarking against industry averages can be helpful, it's essential to remember these are just averages. They don't account for the unique aspects of your business model. Focusing solely on generalized benchmarks can be misleading, especially for businesses with unique products or target markets. Analyzing your own data is key.

Industry Benchmarks and Data-Driven Insights

Lower CAC is often the result of efficient marketing strategies and the right technology. In the B2B SaaS sector, for example, the average CAC is $239. This is significantly lower than many other industries, largely due to the sector's effective use of digital marketing channels for cost-efficient acquisition.

Conversely, industries like Financial Services have a much higher average CAC, around $784. This is often attributed to the need for building client trust and navigating a complex regulatory landscape. For a deeper look at industry-specific CAC, explore this resource: B2B Customer Acquisition Costs Across 55 Sectors.

To understand the factors driving your CAC, assess your own data. This allows for a more focused approach to optimization. Even within high-CAC industries, some companies are successfully defying the trend.

Learning From Success Stories

These companies often implement innovative strategies that prioritize maximizing customer lifetime value and streamlining internal processes. By understanding their approach, you can gain valuable insights to reduce your own CAC. This requires a realistic assessment of what’s achievable within your specific business context. Some cost reduction goals might be overly ambitious, while others may represent untapped potential.

To further illustrate the variations in CAC across different industries, the table below provides a comprehensive breakdown:

Industry-Specific Customer Acquisition Costs Comparison Comprehensive breakdown of average CAC across major industries with cost drivers and optimization opportunities

| Industry | Average CAC | Primary Cost Drivers | Optimization Potential |

|---|---|---|---|

| B2B SaaS | $239 | Marketing & Sales Technology Costs | Automation, Content Marketing |

| Financial Services | $784 | Regulatory Compliance, Client Acquisition | Targeted Marketing, Referral Programs |

| Ecommerce | Varies widely | Marketing, Fulfillment, Returns | Personalized Experiences, Loyalty Programs |

The table above highlights the significant differences in CAC across industries, underscoring the need for a tailored approach to acquisition. While SaaS businesses can leverage technology to lower CAC, Financial Services firms face higher costs due to regulation. Ecommerce CAC, being highly variable, presents unique optimization challenges and opportunities. By understanding these industry-specific dynamics, businesses can better strategize for efficient customer acquisition.

Digital Marketing Tactics That Actually Lower Customer Acquisition Cost

Lowering your customer acquisition cost (CAC) is a major focus for any expanding business. It's about optimizing your marketing budget, not simply cutting costs. This involves pinpointing strategies that deliver the best return on investment. Thankfully, several digital marketing tactics can effectively reduce your CAC without compromising lead quality.

Targeting the Right Audience With Precision

One of the best ways to lower CAC is by concentrating on the correct audience. This requires going beyond basic demographics to truly grasp the specific needs and motivations of your perfect customers. Advanced targeting techniques, such as Facebook Lookalike Audiences, enable you to connect with potential customers who share traits with your current high-value clients. This precise targeting minimizes wasted ad spend and boosts conversion rates.

Knowing where your target audience hangs out online is also key. Investing in the platforms they use, whether it's Facebook, Instagram, or niche industry forums, ensures your message reaches the right individuals. This focused method directly contributes to a reduced CAC.

Conversion Optimization: Beyond the Basics

After attracting the right audience, optimizing your conversion rate is vital. This involves analyzing every stage of the customer journey, from their initial click to the final purchase. Enhancing landing page performance, for example, is a critical component of conversion optimization.

This could mean A/B testing different headlines, calls to action, or even page layouts. Furthermore, simplifying the checkout process, smoothing out any friction points, and providing various payment options can considerably improve conversions and thus decrease your CAC. The cost of acquiring new customers differs significantly across industries. For example, the e-commerce sector has a notably low average CAC of $86, illustrating the power of digital retail. Find more detailed statistics here.

The Power of Retargeting

Even with optimized targeting and conversion strategies, some visitors won't convert on their first visit. This is where retargeting enters the picture. Retargeting lets you re-engage visitors who have shown interest but haven't purchased yet.

By presenting targeted ads based on their past website interactions, you can subtly encourage them toward a conversion. This maximizes the return on your initial ad spend and helps achieve a lower CAC. For instance, if someone adds an item to their cart but abandons it, a retargeting ad featuring that item can be particularly compelling.

Automation and Data Analytics

Finally, automation and data analytics are crucial for lowering CAC. Marketing automation tools like HubSpot can streamline recurring tasks, customize customer interactions, and monitor campaign performance more efficiently. By automating email marketing, social media posts, and other activities, businesses can save time and resources for more strategic initiatives.

Data analytics tools like Google Analytics offer valuable insights into customer behavior, helping businesses understand what influences conversions. This data-driven approach allows marketers to make smarter choices about budget allocation, campaign optimization, and ultimately, reducing CAC. These combined methods create a powerful synergy for sustained growth.

Using Technology And Data To Slash Acquisition Spending

Lowering customer acquisition cost (CAC) is a top priority for businesses aiming for growth. The most successful companies don't just adopt every new technology. They use technology strategically. This involves understanding how tools like artificial intelligence (AI), machine learning, and advanced analytics can truly enhance their customer acquisition process.

Predictive Customer Scoring: Identifying High-Value Prospects

Predictive customer scoring leverages data to pinpoint high-value prospects before acquisition costs escalate. This allows you to concentrate resources on leads with the highest probability of converting into long-term, profitable customers.

For instance, AI can analyze website behavior, past purchases, and demographics to predict which leads are most likely to buy. This focused approach significantly reduces wasted ad expenditure and lowers CAC.

Additionally, early identification of high-value prospects enables tailoring marketing messages and offers to their specific needs. This personalization can boost conversion rates and further reduce CAC, creating a more efficient and cost-effective acquisition strategy.

Automating Campaign Optimization for Real Results

Automating campaign optimization is another powerful way technology can decrease CAC. AI-driven tools can analyze campaign performance in real time, automatically adjusting bids, targeting, and ad creatives to maximize conversions. This eliminates the need for time-consuming manual adjustments, freeing up valuable resources. You might be interested in How to master your ecommerce technology stack.

Moreover, automated optimization ensures your campaigns consistently perform at their peak. By continuously analyzing data and making necessary changes, these tools can help you achieve a lower CAC and maximize ROI. This data-driven method leads to more informed spending decisions and improved outcomes.

Real-Time Performance Tracking and Actionable Decisions

Real-time performance tracking offers valuable data to inform your acquisition strategy decisions. Monitoring key metrics like CAC, conversion rates, and customer lifetime value allows you to identify areas for improvement and optimize campaigns effectively.

This data-driven approach enables quick identification and resolution of issues that might increase your CAC. For example, a sudden CAC spike from a specific channel prompts investigation and corrective action. This proactive approach helps maintain a low CAC and achieve sustainable growth. Companies using this strategic technology implementation have reportedly reduced their CAC by 30-50%.

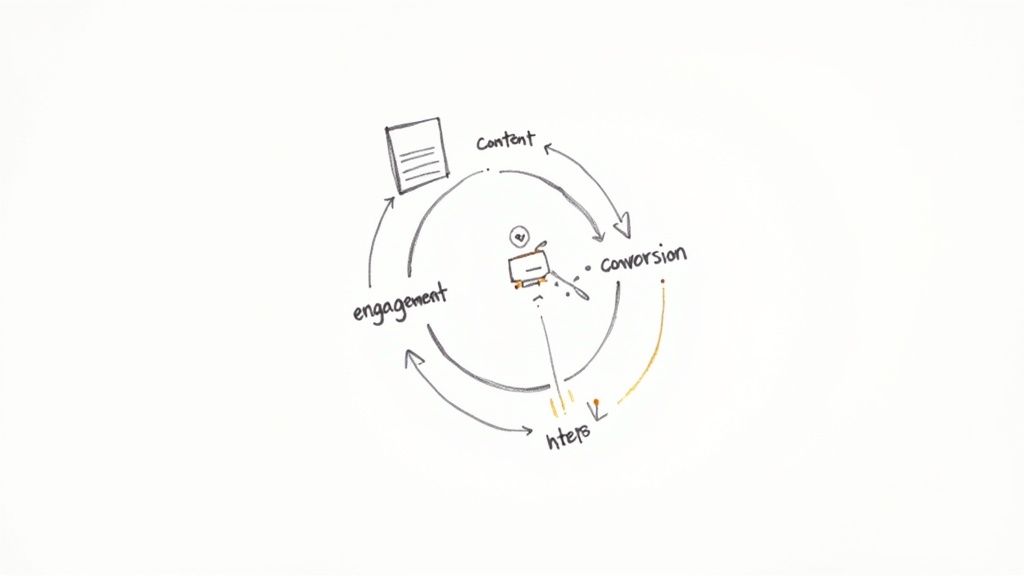

Attribution Modeling: Understanding the Customer Journey

Understanding the customer journey is essential for minimizing CAC. Attribution modeling identifies the touchpoints that genuinely drive conversions. By understanding which marketing channels and campaigns are most impactful, you can allocate your budget strategically and focus on activities yielding the best results.

This clear understanding of the customer journey allows for optimized spending and overall improvement of your acquisition strategy. For example, if content marketing is a key driver of conversions, you might increase investment in creating high-quality blog posts and articles. This strategic resource allocation can lead to a lower CAC and increased ROI.

Fixing The Leaks In Your Sales Funnel

A leaky sales funnel can quietly drain your resources, increasing your customer acquisition cost (CAC) without you even noticing. Many businesses prioritize attracting new leads but overlook inefficiencies in their existing sales process. This section examines common bottlenecks and helps you identify what's truly impacting your bottom line.

Analyzing Each Stage: From Awareness To Conversion

Lowering your CAC requires a systematic approach to funnel analysis. This means examining each stage, from initial awareness to final conversion. Think of your funnel as a series of pipes. Each connection represents a potential leak.

Identifying these weak points allows you to implement targeted solutions. This focus on specific areas will produce measurable results and improve your overall sales performance.

For example, a high bounce rate on your landing page signifies a problem at the top of your funnel. Your messaging might not resonate, or the page might load slowly. A low lead-to-customer conversion rate could suggest issues with your sales process or pricing.

Optimizing Landing Page Performance

Optimizing landing page performance is crucial for lowering CAC. This goes beyond simple design tweaks. It involves aligning your messaging with user intent and creating a frictionless path to conversion.

This could mean simplifying forms, highlighting customer testimonials, or creating a compelling call to action. Mobile optimization is also critical in today's market.

Streamlining Lead Qualification And Reducing Time-To-Close

A streamlined lead qualification process focuses resources on the most promising prospects. This often involves implementing lead scoring systems. These systems assign points based on demographics, engagement, and purchase intent.

This prioritization empowers your sales team to focus on high-value leads, reducing wasted time on unqualified prospects. Focusing on promising leads reduces time-to-close without resorting to high-pressure tactics. This, in turn, contributes to a lower CAC.

Nurturing Leads Effectively With Targeted Content

Effective nurture sequences keep potential customers engaged cost-effectively. This involves providing valuable content at each stage of the buyer journey, addressing their specific needs. Consider a drip email campaign with helpful resources.

If a lead downloads a whitepaper, follow up with related blog posts, case studies, or product demos. Consistent engagement keeps your brand top-of-mind and guides prospects towards purchasing.

Using Behavioral Triggers To Guide Prospects

Behavioral triggers, like website visits or email opens, can strategically guide prospects. This could involve sending targeted emails based on specific actions, personalizing content based on browsing history, or offering timely promotions.

Using these triggers effectively moves prospects down the funnel and increases conversion rates, ultimately lowering CAC.

To understand the potential impact of these optimizations, let's look at a breakdown of how improvements at each funnel stage can affect your results. The following table provides estimated ranges for improvements, implementation difficulty, time to see results, and cost reduction impact. These figures are estimates and can vary based on your specific business and industry.

| Funnel Stage | Average Improvement | Implementation Difficulty | Time to Results | Cost Reduction Impact |

|---|---|---|---|---|

| Awareness (Website Traffic) | 10-30% | Low | 1-3 months | Low |

| Interest (Lead Generation) | 15-40% | Medium | 2-4 months | Medium |

| Consideration (Lead Nurturing) | 20-50% | Medium | 3-6 months | High |

| Action (Sales Conversions) | 5-25% | High | 2-6 months | High |

| Loyalty (Repeat Customers) | 10-20% | Medium | 6-12 months | High |

As this table demonstrates, focusing on optimizing each stage of your sales funnel can have a significant impact on your overall customer acquisition cost and revenue generation. While some improvements may take longer to implement and see results, the potential cost savings and increased conversions make the effort worthwhile.

Building Retention To Reduce Your 2 Acquisition Dependency

Lowering your customer acquisition cost (CAC) isn't solely about attracting new customers. It's equally crucial to retain existing ones. Exceptional customer retention creates a compounding effect, strengthening your acquisition economics over time. A loyal customer base reduces the need for constant new acquisitions, easing pressure on your acquisition channels.

The Relationship Between Customer Lifetime Value and Acquisition Cost

The true power lies in understanding the link between customer lifetime value (CLTV) and CAC. Even minor retention improvements can significantly impact CLTV, making your acquisition spending more effective. Like a snowball gathering momentum, a small increase in retention has an exponentially growing impact over time. If a customer stays just a month or two longer due to improved retention, their lifetime value increases, balancing your initial acquisition investment.

Strategies for Effective Customer Onboarding

Effective customer onboarding is the starting point. A well-designed onboarding experience sets the stage for the entire customer relationship. This involves providing clear instructions, helpful resources, and proactive support from the outset. By delivering immediate value, you encourage customers to stay engaged. You may find this helpful: How to master ecommerce customer retention.

Loyalty Programs That Drive Behavior Change

Implementing impactful loyalty programs is another key retention tactic. This goes beyond simple discounts. It's about fostering a sense of community and rewarding engagement. A points-based system rewarding purchases, referrals, and social media interaction, for example, can build long-term loyalty and boost CLTV. Consider offering exclusive early access to new products or a tiered system with escalating benefits.

Proactive Customer Success Programs

Creating proactive customer success programs to preempt churn is vital. This involves identifying early signs of dissatisfaction. Are certain features underutilized? Have support tickets risen? Addressing these issues proactively retains customers and minimizes churn. This could involve personalized outreach, targeted training, or simply checking in.

Turning Satisfied Customers Into 2 Acquisition Channels

Finally, satisfied customers can be your strongest acquisition channel. Genuine referrals and word-of-mouth marketing are often more effective than paid advertising. Encourage customers to share their positive experiences with incentives for referrals and easy social sharing. This authentic advocacy significantly lowers your CAC over the long run. A simple referral program or streamlined social sharing can transform your customers into brand ambassadors, driving organic growth and reducing reliance on costly acquisition strategies. Focusing on retention builds a sustainable foundation for long-term growth, where your customers become your most valuable marketers.

Tracking Progress and Optimizing Your Results

Successfully reducing your customer acquisition cost (CAC) involves more than simply implementing new strategies. It requires a dedicated approach to analyzing data and making continuous improvements. This means tracking the right metrics and making data-driven decisions about how you acquire customers. This section offers a framework for accomplishing this.

Essential Metrics Beyond Basic CAC Calculations

Calculating your overall CAC is a crucial starting point, but it only scratches the surface. You can gain more detailed insights by analyzing metrics like cohort analysis, channel attribution, and customer lifetime value (CLTV).

Cohort analysis groups customers acquired during the same timeframe to understand patterns in their behavior and spending habits. This can reveal the true value of specific customer segments.

Channel attribution helps you understand which marketing channels are actually leading to conversions and lowering your CAC. Knowing this allows you to allocate your budget more strategically. By prioritizing high-performing channels, you can optimize your return on investment (ROI) and minimize wasted ad spend.

Tracking CLTV is also essential. Understanding how much revenue a customer generates over their entire relationship with your business informs your spending decisions. A higher CLTV often justifies a higher CAC, enabling you to confidently invest more in acquiring high-value customers.

Automated Reporting Systems for Actionable Insights

Setting up automated reporting systems is crucial for continuous improvement. These systems should deliver actionable insights, not just raw data. Automated reports should highlight key trends, flag potential problems, and suggest areas for optimization. This gives you the power to make proactive changes and consistently lower your CAC.

For instance, a sudden spike in CAC from a specific channel might trigger an alert. This allows you to quickly investigate the issue and take corrective action. This proactive approach helps prevent small issues from becoming major budget concerns.

Leading Indicators and Predictive Modeling

Identifying leading indicators that signal CAC changes before they negatively impact your bottom line is another valuable approach. A decrease in website traffic or a drop in conversion rates, for example, might indicate a potential CAC increase. Recognizing these warning signs early allows you to implement preventative measures and maintain a healthy acquisition cost. Learn more in this article on How to Master Your Marketing Efficiency Ratio.

Predictive modeling is a more advanced method that helps forecast future acquisition costs. By analyzing historical data and market trends, you can anticipate potential CAC changes and proactively adapt your strategy. This forward-looking perspective helps you manage your acquisition spend and stay ahead of the competition.

Accountability Systems for Results That Matter

Finally, establishing accountability systems helps your team stay focused on reducing CAC. This means defining clear objectives, regularly monitoring progress, and celebrating achievements. By fostering a culture of accountability, you can ensure everyone is aligned on the common goal of efficient customer acquisition.

Regular performance reviews, for instance, reinforce the importance of CAC optimization and acknowledge individual contributions. Linking incentives to CAC reduction can further motivate team members and generate better results. This collaborative approach encourages shared ownership and a data-driven mindset toward customer acquisition.

Your Action Plan For Lower Customer Acquisition Cost

Knowledge is power, but only when put into action. This section provides a practical, step-by-step plan to lower your customer acquisition cost (CAC), regardless of whether you're a startup or an established company.

Prioritizing Initiatives and Building Momentum

First, prioritize initiatives based on their potential impact and available resources. Focus on areas where you can achieve the biggest wins with what you have. This maximizes your return on investment (ROI) and ensures efficient use of your team's time.

For example, a limited budget might favor organic social media and content marketing over paid advertising. A strong sales team could see significant returns from referral programs.

Next, establish realistic timelines. Sustainable cost reduction takes time. Break down large initiatives into smaller steps with clear deadlines to prevent overwhelm and maintain team motivation.

Consider your team's capacity. Gradual implementation is more sustainable and allows for adjustments. This iterative approach minimizes disruption and boosts the likelihood of success.

Finally, secure organizational buy-in. Clearly communicate the benefits of lower CAC to all stakeholders. Shared understanding fosters collaboration and increases the chances of achieving your goals.

Practical Tools and Frameworks for Implementation

Use practical tools to keep your initiatives on track. Templates, checklists, and project management frameworks can streamline implementation and monitor progress, providing structure and accountability.

Templates: Use pre-built templates for tasks like creating landing pages, email sequences, or social media campaigns. This saves time and ensures consistency.

Checklists: Checklists prevent costly oversights by ensuring all necessary steps are completed. Use them for tasks like launching campaigns or optimizing landing pages.

Project Management Frameworks: Implement a project management framework like Agile or Scrum to manage complex initiatives, providing a structured approach to planning, execution, and progress monitoring.

Navigating Challenges and Maintaining Momentum

Challenges will arise. Anticipate common implementation pitfalls and develop contingency plans to minimize setbacks.

For example, if a marketing campaign underperforms, have a plan to quickly adjust. This might involve A/B testing different ad creatives, targeting a new audience, or revisiting your messaging.

Maintain momentum even if initial results are disappointing. Analyze the data, identify areas for improvement, and adjust your approach. This iterative process is key to long-term, sustainable cost reductions. Celebrate small wins to keep your team motivated and engaged. Reducing CAC is an ongoing process, not a one-time fix.